https://plus.google.com/112652098805502638182/posts/5ztbVCdXefv

https://plus.google.com/112652098805502638182/posts/47n45ox5zSi

https://plus.google.com/u/0/101579362800691594786/posts

The Fed just recently revealed they would certainly proceed their existing speed of acquiring bonds up until the economic climate was stronger. This bond purchasing program is the factor that mortgage rate of interest are at historic lows. Fees began to increase over the last several months simply on the anticipation that the Fed would announce that they would be lessening the level of bond acquisitions last month. When that didn't happen, fees actually decreased (4.50 to 4.37).

The Fed just recently revealed they would certainly proceed their existing speed of acquiring bonds up until the economic climate was stronger. This bond purchasing program is the factor that mortgage rate of interest are at historic lows. Fees began to increase over the last several months simply on the anticipation that the Fed would announce that they would be lessening the level of bond acquisitions last month. When that didn't happen, fees actually decreased (4.50 to 4.37).

That was excellent information for any buyer in the process of buying a residence. Nonetheless, this glass of possibility is expected to close in the really close to future as many professionals anticipate the Fed to taper the bond purchasers in December. Even Ben Bernanke, Chairman of the Fed, suggested that the Fed can still downsize the stimulation this year. He explained:.

"If the information confirms our fundamental attitude, after that we can relocate later on this year.".

Where will mortgage rates head in 2014?

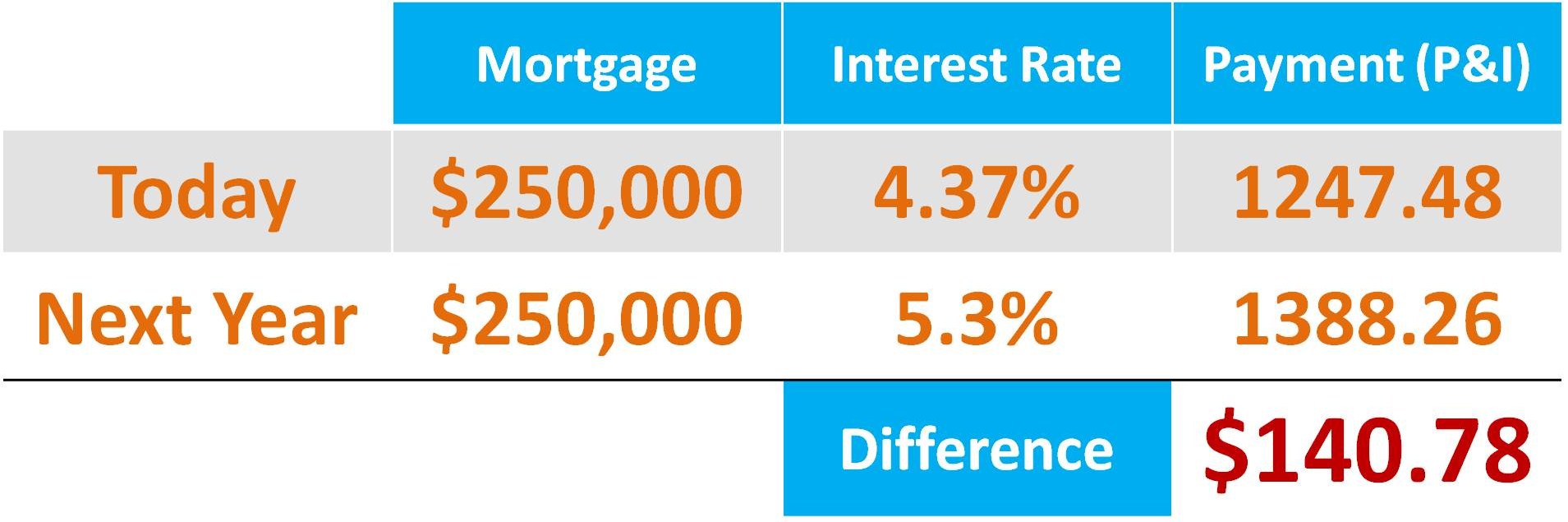

The Home mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Organization of Realtors have actually each forecasted that the 30 year corrected fee mortgage will have rates of interest in extra of 5 % by now next year. The standard of their 4 estimates is 5.3 %. The table below shows the effect this will certainly have on the month-to-month principal and interest payment on a $250,000 home mortgage:.

Repayment A buyer should make use of the current window of chance before it is late.

The post Buyers: Mortgage Home Loan Window of Possibility Still Open appeared first on The So Cal Loan Pro.

http://www.l-a-real-estate.com/meet-the-owner-teresa-tims

https://plus.google.com/114577963924971182403